USDA Rural Development Mutual Self-Help Housing Program

Qualification & Process for USDA RD Section 523 Mutual Self-Help Housing Program

Qualification Requirements

- Income Eligibility: Borrowers must fall within the very low- to low-income bracket as defined by USDA guidelines.

- Location: Applicants must seek housing in eligible rural areas specified by USDA Rural Development.

- Creditworthiness: While flexible, applicants should demonstrate a capacity to afford a mortgage with payment assistance.

- Job Stability: Borrowers should demonstrate reliable employment history and income stability.

- Willingness to Participate: Homebuyers must be committed to working alongside others to build homes through sweat equity.

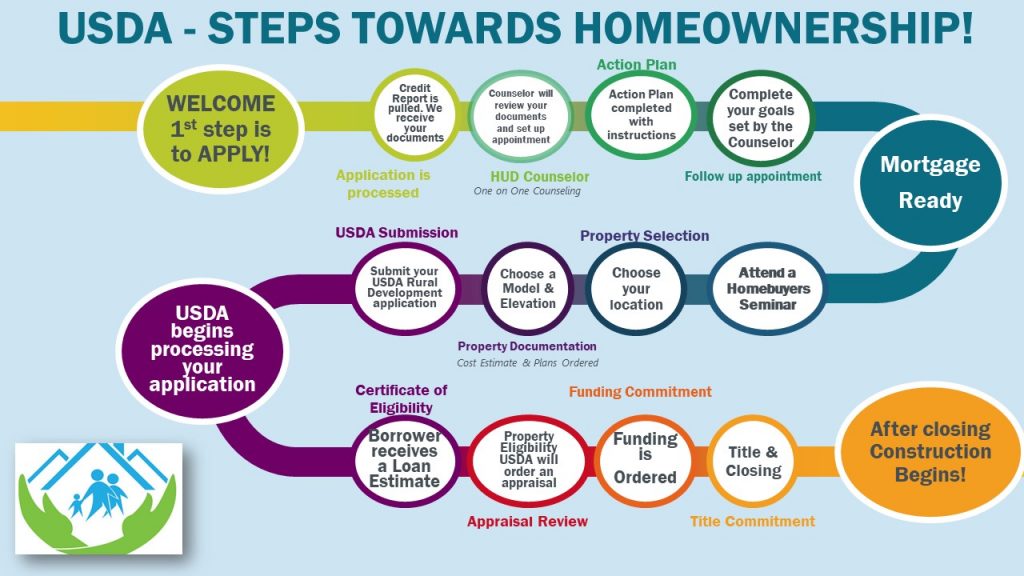

Application & Approval Process

- Initial Application & Screening:

- Applicants submit their information to Homes In Partnership, Inc. for review.

- Income, credit, affordability, and location eligibility are assessed.

- Pre-Construction Preparation:

- Approved applicants receive homebuyer education and financial counseling.

- Groups are formed, and participants learn about construction responsibilities.

- Sweat Equity Homebuilding:

- Under the guidance of a construction supervisor, groups collaborate to build each other’s homes.

- Mandatory Work includes tasks such as painting, landscaping, interior finishing, etc.

- Final Inspection:

- Homes undergo final inspections to ensure quality and safety.

- Once construction is complete, buyers officially transition their USDA construction loan to a permanent mortgage loan and move into their brand-new home.

This program fosters community, affordability, and empowerment, making homeownership accessible.

Applicants are required to meet several qualifications to ensure success. Each prospective homeowner must:

- Must be a US citizen or legal resident

- Overall credit history should demonstrate the ability and willingness to repay obligations

- Must have a 2-year work history and have filed 2 years of tax returns if employed

- Conform to the minimum and maximum Income Guidelines depending on family size and location. Click here to check the income limits for your area: https://www.rd.usda.gov/sites/default/files/RD-DirectLimitMap.pdf

- Willing to participate in certain aspects of the construction of your home and others

- Attend homebuyer workshops and meetings

- USDA requires homes to be in rural areas. Click here for property eligibility information: https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?pageAction=sfpd. Click on ACCEPT, then type the address you wish to purchase.

- The home you will purchase must be your primary residence, not owning another home

- USDA SELF-ASSESSMENT WEBSITE: Final determination of eligibility must be made by USDA Rural Development https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?pageAction=assessmentType